tax shield formula uk

Tax Shield Donation to Charitable Trusts Interest Expenses Depreciation Expenses Applicable Tax Rate. Assume Case A brings after-tax income of 80 per year forever.

Modelling The Impact Of Increased Alcohol Taxation On Alcohol Attributable Cancers In The Who European Region The Lancet Regional Health Europe

Tax Shield is calculated as.

. Interest Tax Shield Interest Expense Tax Rate For instance if the tax rate is 210 and the company has 1m of interest. Tax Shield Value of Tax-Deductible Expense x Tax Rate. What is the formula for tax shield.

44 01384 563098 Sales. Without the depreciation tax shield the company will have to pay 250000 in taxes as it has a 25 tax rate and 1000000 in revenues. Depreciation Tax Shield Formula Depreciation.

TAX to be Paid over Income Revenues- Operating Expenses-Depreciation-Interest Expenses x tax rate. Calculating the tax shield can be simplified by using this formula. In the line for the initial cost.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest medical. The formula for this calculation can be presented as follows. The formula for tax shields is very simple and it is calculated by first adding the different tax-deductible expenses and then multiplying the result by the tax rate.

Under this assumption the value of the tax shield is. Investment Cost Marginal Rate of Income. A Tax shield is a necessary reduction in an individual or corporations taxable income achieved when a huge amount of expenses incorporate.

Interest Tax Shield Formula Average debt Cost of debt Tax rate. What is the Tax Shield Formula. The formula for calculating the depreciation tax shield is as follows.

Interest bearing debt x tax rate. 44 0870 609 1918 charges may. On the other hand if we take the depreciation tax.

Or the concept may be applicable but have less impact if. It can be calculated by multiplying the deductible depreciation expense by the tax rate applicable to your business. Or EBT x tax rate.

Tax Shield Amount of tax-deductible expense x Tax rate. Using the above examples. The formula for calculating the interest tax shield is as follows.

How to calculate tax shield due to depreciation. The Ascent explains how your small business can shield income from taxes. To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give you 3500.

Tax Shield Formula Sum of Tax-Deductible Expenses Tax rate. TABLE III A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX PAYABLE DUE TO CAPITAL COST ALLOWAICE. Web formula shield tax uk.

How to calculate after tax salvage valueCORRECTION. Learn to increase your cash flow by using tax shields to reduce net income. Tax and accounts software for accountants tax specialists SMEs and business owners Your Account Your Basket Support.

Rishi Sunak has pledged to make the fight against a rising cost of living his No 1 priority after surging energy bills sent the UKs annual. We note that when depreciation expense is. Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒.

To increase cash flows and to further increase the value of a business tax shields are used. PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new asset acquired after November 20 2018 𝐶𝑑𝑇 𝑑𝑘 115𝑘 1𝑘 Notation. How Tax Shields Work for Small.

The effect of a tax shield can be determined using a formula. First published on Wed 16 Nov 2022 0200 EST. The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction.

Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be manually. In this video on Tax Shield we are going to learn what is tax shield. How to calculate NPV.

TAX to be Paid over Income Revenues- Operating Expenses-Depreciation-Interest. A tax shield is the reduction in the taxable income by way of claiming the deduction allowed for the certain expense such as depreciation on the assets interest on the debts etc and is. Tax Shield 5000 40000 10000.

Uk Must Raise Taxes And Cut Spending Hunt Says Ahead Of Budget Reuters

Formula E Presenter Nicki Shields Becomes Fia Girls On Track Ambassador Fia Formula E

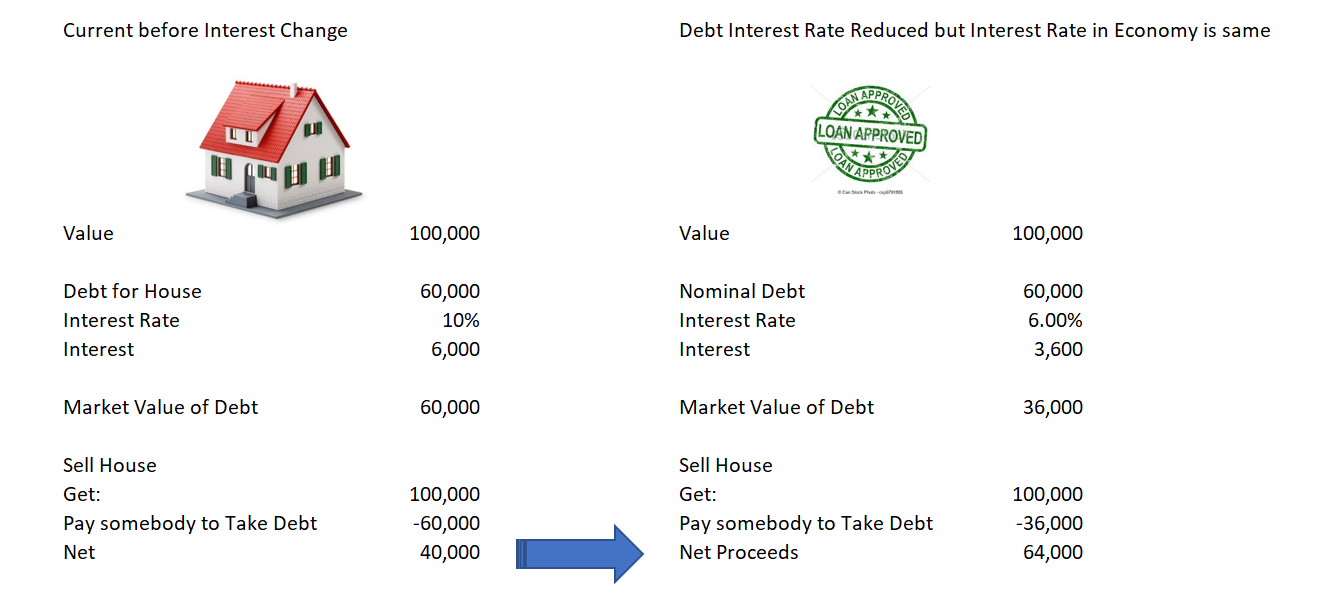

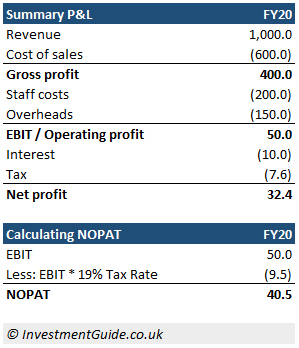

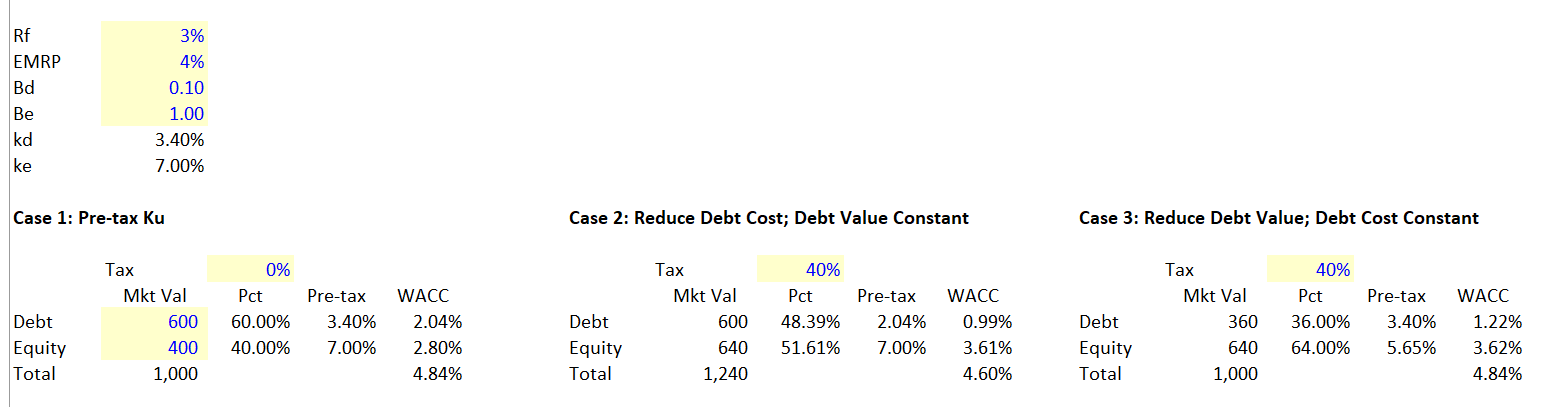

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

As Uk Energy Bills Spike Bp And Shell Could Face Windfall Tax Cnn Business

Discounted Cash Flow Dcf Valuation Investment Guide

Cima Spreadsheet Skills Debt Sculpting

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula How To Calculate Tax Shield With Example

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Tax Shield Definition Example How Does It Works

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Tax Shields Financial Expenses And Losses Carried Forward

Tax Shield Formula Step By Step Calculation With Examples

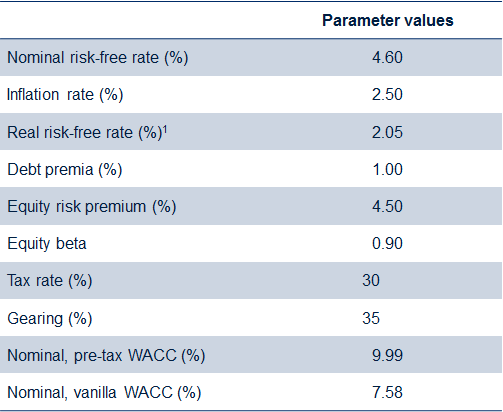

Which Wacc When A Cost Of Capital Puzzle Revisited Oxera

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Amazon Com Bonide 1gal Rose Shield Rtu W Power Sprayer Patio Lawn Garden

Depreciation Tax Shield Formula And Calculation

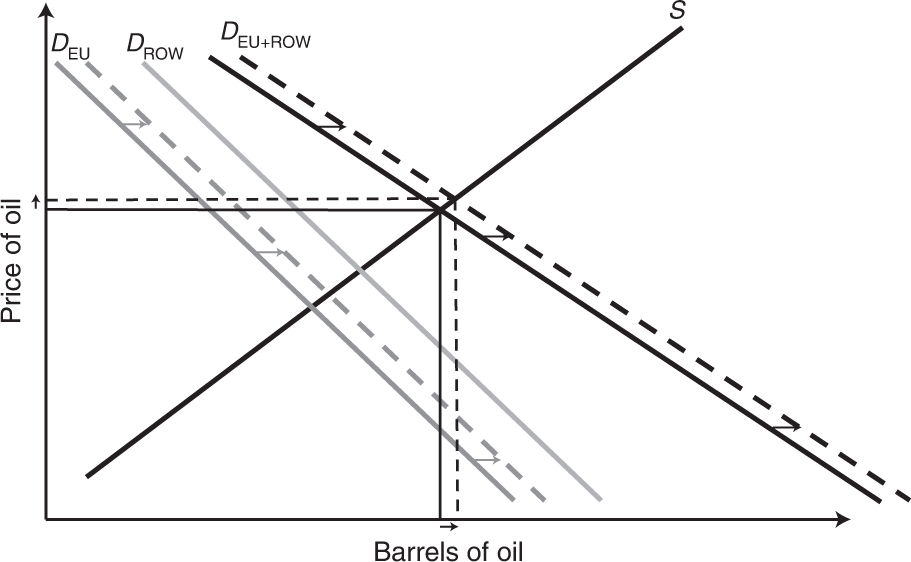

The Effect Of European Fuel Tax Cuts On The Oil Income Of Russia Nature Energy