nj tax sale certificate

There are 2 types of tax sales in New Jersey. 280 Grove St Rm 101.

![]()

Tax Sales Tax Collectors Treasurers Association Of Nj

The New Jersey Supreme Court in In re.

. Sale of certificate of tax sale liens by municipality. Princeton Office Park LP. Once registered you must display your Certificate.

City of Jersey City Tax Collector. 18 or more depending on penalties. According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax.

Purchasers of tax sale certificates liens. New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of Taxation. When a property is included in the tax sale a lien is sold for the amount of the eligible municipal charges together with interest to the date of the tax sale and.

New Jersey is a good state for tax lien certificate sales. New Jersey Sales and Use Tax. The procedures that govern tax foreclosure are set down in the Tax Sale Law NJSA.

Sales subject to current taxes. When a Property is in the Sale. Title Practice 10117 4th Ed.

In Person - The Tax Collectors office is open 830 am. Here is a summary of information for tax sales in New Jersey. As a seller of taxable goods or services you are required to be registered with the New Jersey Division of Revenue and Enterprise Services.

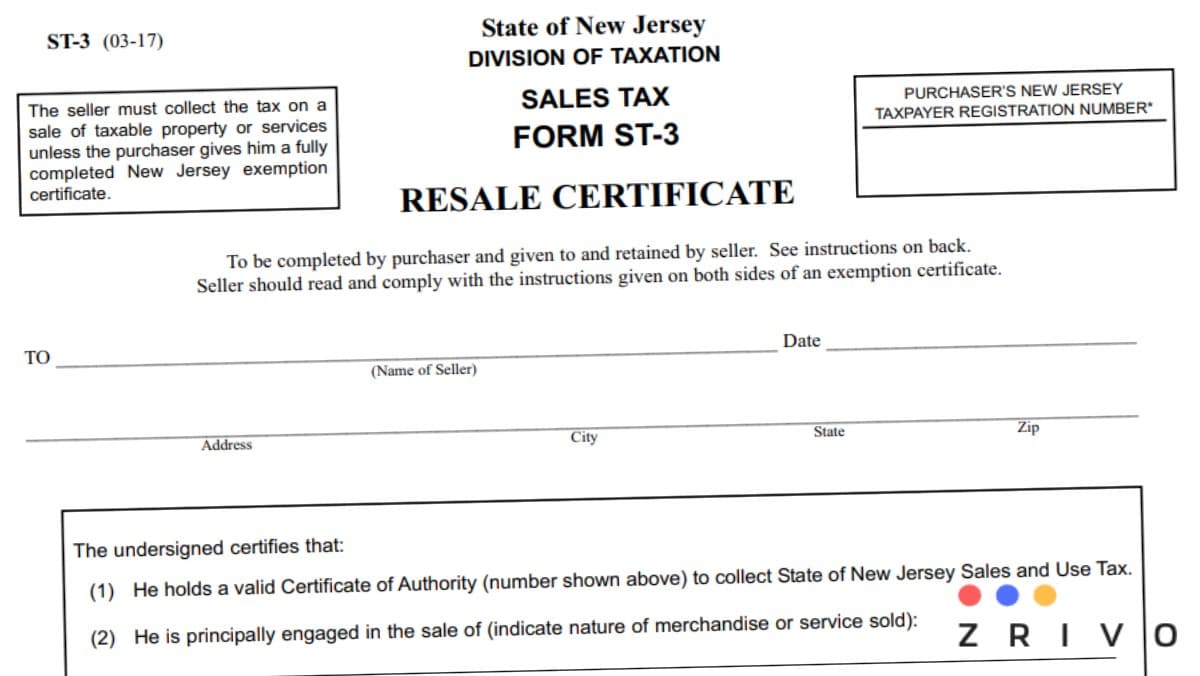

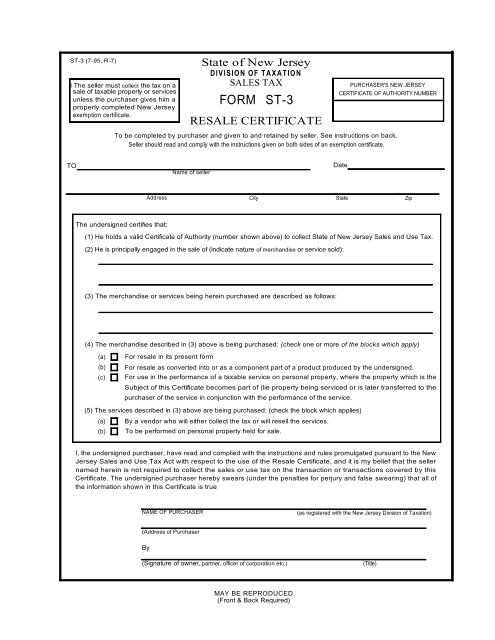

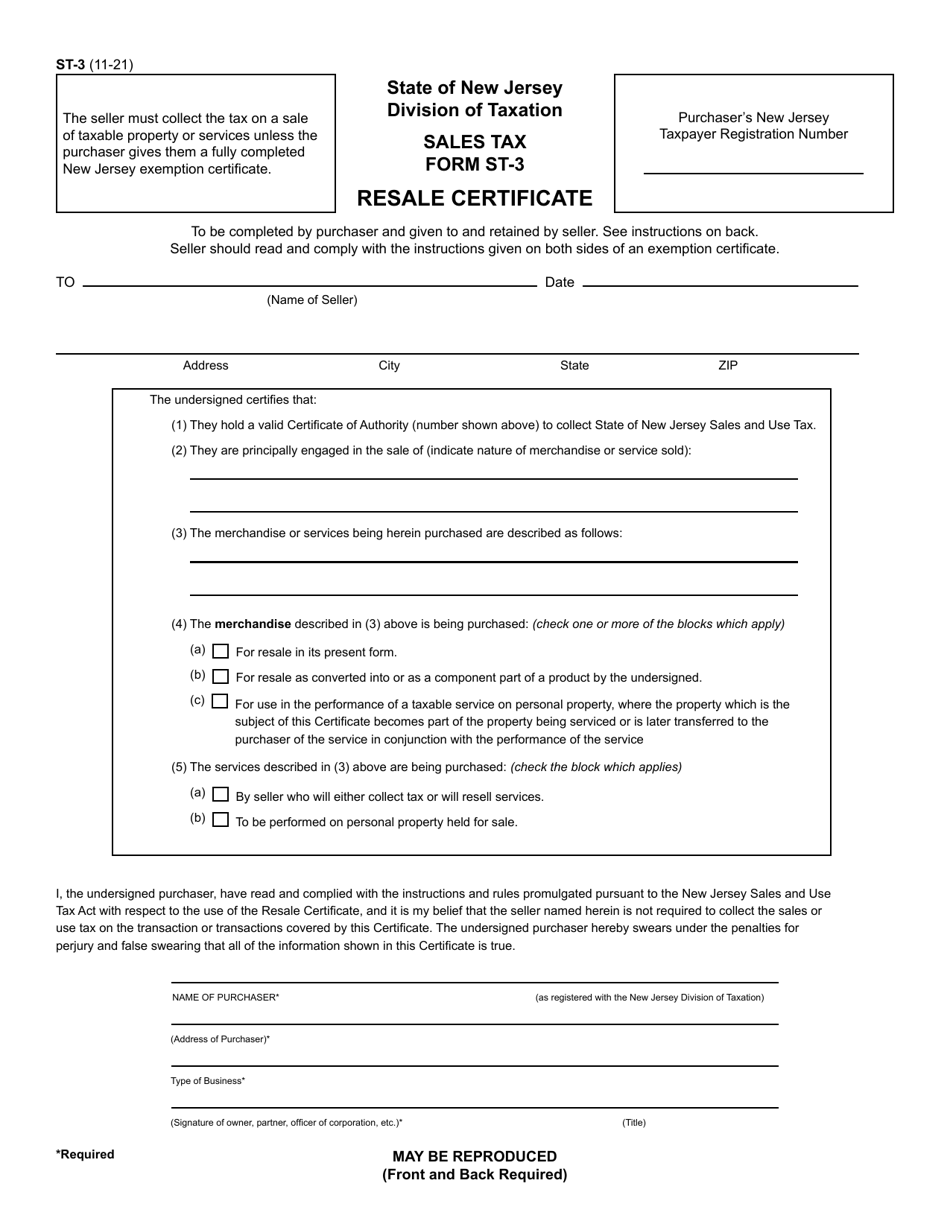

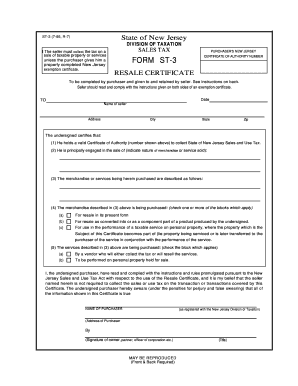

30 rows Sales and Use Tax. Due to changes in the New Jersey State Tax Sale Law the tax collector must create the tax sale list 50 days prior to the sale and all charges on that list together with cost of sale must be paid. Therefore you can complete the ST-3 resale certificate form by providing your New Jersey Sales Tax Permit Number Taxpayer Registration Number.

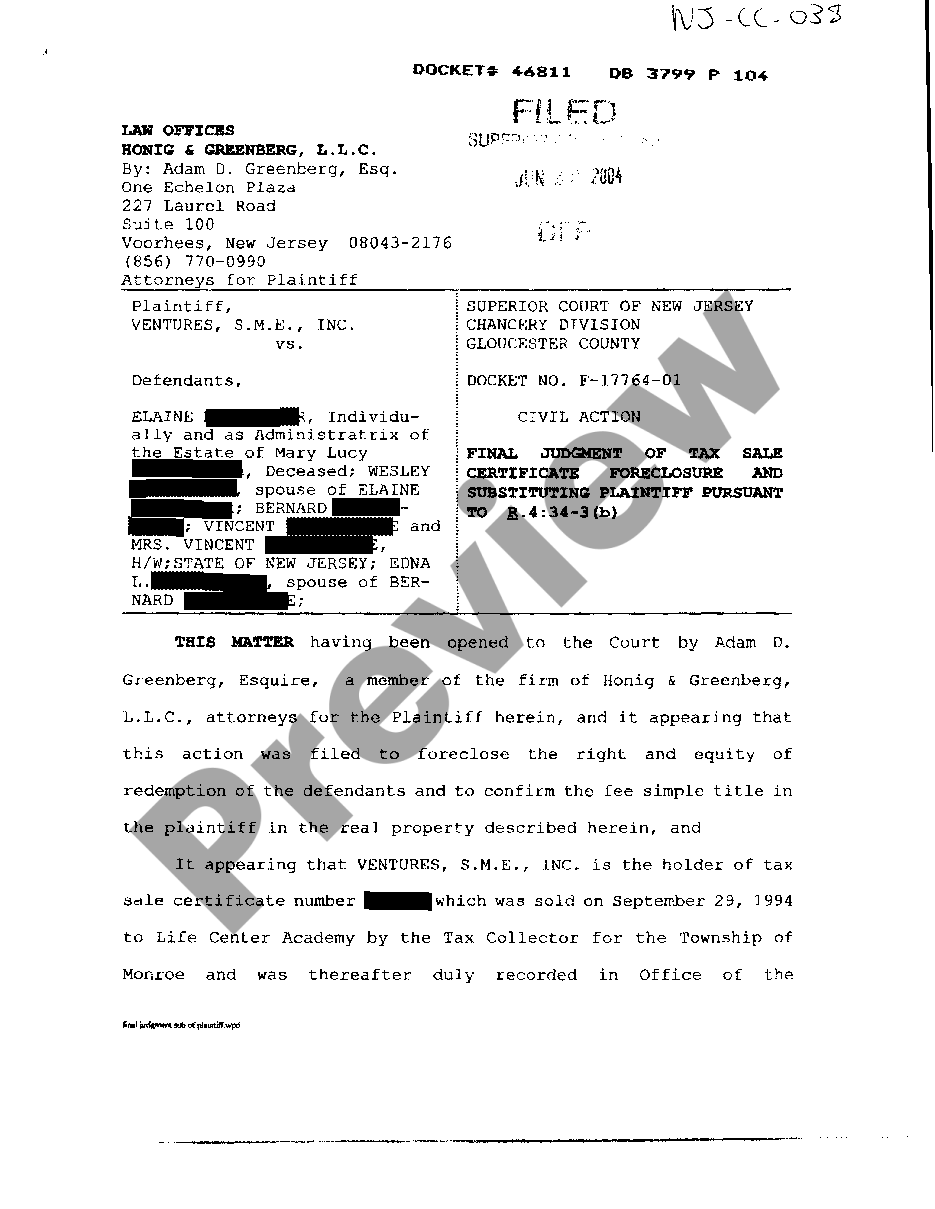

The accelerated tax sale is held prior to the end of. Plymouth Park Tax Services LLC determined that under the Tax Sale Law NJSA. The standard tax sale is held within the current year for delinquent taxes of the prior year.

Redemption of tax sale certificates TSCs can present difficulties for buyers and sellers as well as for their attorneys and title companiesNJ. By Mail - Check or money order payable to. After July 1 2017.

Complete a New Jersey Sales. As with any governmental activity involving property rights the process is not simple. 545-1 to -137 a.

New Jersey Final Judgment Of Tax Sale Certificate Foreclosure And Substituting Plaintiff Pursuant Us Legal Forms

The Official Website Of The Town Of West New York Nj Tax

Form St 3 Fillable Resale Certificate

New Jersey Sales Tax Small Business Guide Truic

How To Register For A Sales Tax Permit In New Jersey Taxvalet

Registrations And Certifications Aorbis

Form Tpt 3 Fillable Tobacco Products Wholesale Resale Certificate

Sales Tax Exemption For Building Materials Used In State Construction Projects

New Jersey Tax Lien Certificates Deal Of The Week Franklin Nj Youtube

How To Buy Tax Liens In New Jersey With Pictures Wikihow

Keeping Your Home After A Nj Tax Foreclosure Sale

What Are Tax Lien Certificates How Do They Work

Sales Tax Form St 3 New Jersey Resale Certificate Pdf4pro

Form St 3 Download Printable Pdf Or Fill Online Resale Certificate New Jersey Templateroller

Nj Resale Certificate Fill Out And Sign Printable Pdf Template Signnow

Nj Tax Sale Foreclosure Statute Of Limitations Nj Tax Foreclosure